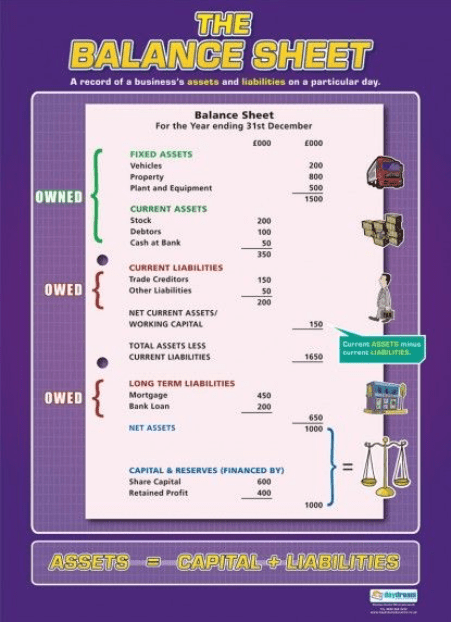

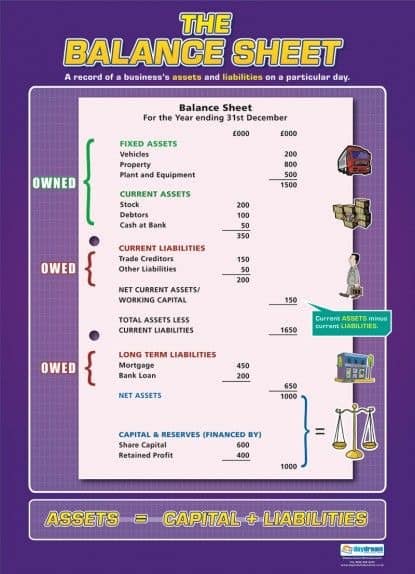

Do you know how to read your Balance Sheet?

A Balance Sheet includes:

- Assets

Assets are the positive items that a business owns. Assets include mainly Cash in the Bank, Monies owing from customers (Debtors), Motor Vehicles, Plant & Equipment, and Office Equipment. Assets can be broken up into current assets (can be converted into cash within 12 months) and non current assets (can only be converted into cash in a time span over 12 months). - Liabilities

Liabilities are the negative items that a business owes. Liabilities include mainly Bank Loans, Monies owing to suppliers (Creditors), Hire Purchase or Lease agreements, Business Credit Cards, GST Liability, PAYG Wages Tax payable, and Provision for Income Tax. Liabilities can be broken up into current liabilities (can be converted into cash within 12 months) and non-current liabilities (can only be converted into cash in a time span over 12 months).

Tips to managing your Balance Sheet:

Reconcile Bank Account(s)

Keep informed of your cash flow position by reconciling your bank accounts on a fortnightly or monthly basis. It is important that the amount included on the Balance Sheet is the actual amount you can spend.

Monitor Debtors

Check your Debtors Listing (monies owed to you by your customers) and ensure any overdue amounts are chased up at least once a month. If you lose sight of what money is owed to your business then you could also be providing repeat business for a non-paying customer.

Reconcile Bank Loan(s)

Bank Loans should be reconciled on a monthly basis to ensure that your Balance Sheet amount shown for Bank Loan owing is the correct amount and any redraws, extra repayments and interest charged have been included.

Monitor Creditors

Creditors should be updated at least once a month to assist your end of monthly supplier payment process. In simple terms, at the end of the month, you can compare your monies in the bank (if it is reconciled to the bank) to what you owe suppliers to determine how much you can actually pay out of your bank account.

Employ a good Bookkeeper

You should have a good relationship with your bookkeeper and have confidence in his/her work. After all, your bookkeeper is handling all the money going in and out of your business. By employing a well-educated bookkeeper your business will run more smoothly and your accountant bills will be stable.

Please contact Marie De Angelis for further information on marie@mdaacounting.com.au or to get a quote on our services.

See MDAs website at www.mdaaccounting.com.au.